In Nature, the big fish eat the small fish, and web dominance in cyberspace is no different with tech giants taking over partners, competitors, and promising start-ups. The movers and shakers in various industries have many strategies to keep them on top like consolidating, designing new products, going into other services, and expanding capabilities – all of which make them hungry for acquiring both established and fledgling solution providers to either crush emerging competition or expand their core strength without the downtime. According to a ten-year study, Microsoft and Google are the two companies that are most focused on AI and machine learning and buy-outs are in the billions – but nothing close to the $32B purchase of ARM, a U.K. based chip design company by Softbank in 2016 and its $33B purchase of Fortress Investment Group, an asset management company in 2017

In 2012, Google, one of the pack leaders in this PACMAN-like game of M & A spent more than the combined acquisition spending of its biggest competitors using a simple guide, “create beautiful, intuitive services and technologies that are so incredibly useful that people use them twice a day (like a toothbrush)”. Enroute to Google Home and Alexa, the path was strewn with successes and curveballs.

From 2006-2014, it spent over $24.5B on acquiring YouTube for (only) $1.6B, Waze, Double Click, NestLabs, ITA, AdMob, and other companies that supported Google’s vision of dominating online advertising, mobile ads, home automation technology, travel, satellite imaging, and GPS Technology. It lucked out on Motorola, an expensive acquisition at $12.5B which was eventually sold to Lenovo. Its acquisition of Deepmind in 2014 entrenched it in the world of machine learning. Although acquisitions slowed down in 2015-2017, Alphabet (Google’s mother company), remained as the company of choice of start-ups. 11% opted for Google to take over their company, 5% favored Facebook while Amazon and Salesforce tied at 4%. From 2017 to the present, Google is definitely eyeing more cloud, AI, AR, and hardware companies – aside from software that could see Google Assistant (already available in 400M devices worldwide) reigning supreme. Proof of this is the acquisition of Kaggle, an online community of 600,000 data scientists known for hosting data science and machine learning competitions. Brainpower on steroids that could push Google Assistant on even more Android phones, iPhones, Google home products, and other electronic equipment and gadgets.

“I used to have this debate with Steve Jobs, and he would always say, ‘You guys are doing too much stuff.’ He did a good job of doing one or two things really well. We’d like to have a bigger impact on the world by doing more things.”

Larry Page, Google CEO in Business Insider

Speaking of Steve Jobs, Apple uses M & A to strengthen their core products. Focusing on innovativeness and functionality, Apple stays ahead of the game by taking some shortcuts -mainly, buying-out technologies from start-ups for integration into their existing computer and smartphone technologies. However, compared to Google, Apple is definitely more frugal at $6B total M & A spending. Eleven acquisitions cost Apple between $200M-$500M, and only BEAT Electronics surpassed the billion mark in 2014 at $3B. In fact, NeXT Computer was bought for only $400M and SIRI for what seems to be a paltry sum of $250M. The drive has now shifted from Mac support to mobile and AI. Turi and Lattice Data are focused on AI, PA Semi and Anobit Technologies target chip performance, C3 Tech for mapping, and Authen Tec for Apple Pay.

Typically, Apple completed the buy-out of Workflow, an automation tool for iPad and iPhone and will be hiring its creators. In what seems to be a surprise move wrapped up 2017, by buying Shazam, a London-based company that has gained unicorn status on the strength of its song recognition app. Apple also acquired Lattice.io for less than $200 and according to Computer World, “The startup provides an AI-enabled engine that can take unstructured ‘dark’ data and turn it into meaningful and structured insights.” Something definitely to look forward to as Apple expands its realm from purely consumer electronics to machine learning.

“Overall, these top deals reflect Apple’s strategy evolution, from a focus on the Mac platform (NeXT Computer) in the late 1990s to mobile (PA Semi, Anobit Technologies) and AI (Turi, Lattice Data) more recently.”

– CB InsiGHTS, Dec. 2017

Yahoo, one of the strongest players in the Internet age has been bought by Verizon for $4.5 billion. Yahoo will be combined with AOL to form a new subsidiary called OATH. It will eventually be on top of 50 media brands affecting about 1billion people globally.

With Google attempting to dominate the machine learning space, Microsoft seems the runaway leader in AI with its focus on AI products and solutions. It has steered away from computer products to generating 2/3 of its almost $30B revenue from its intelligent cloud platforms, consulting services, and enterprise software licenses. True to the Bill Gates vision, Microsoft is attempting to provide AI access to more people. CEO Satya Naella said, “we acquired AI deep learning startup Maluuba, whose work in natural language processing will help advance our strategy to democratize AI for everyone.” Of course one of the biggest news is the acquisition of LinkedIn – the social media of choice of professionals, entrepreneurs, and decision-makers.

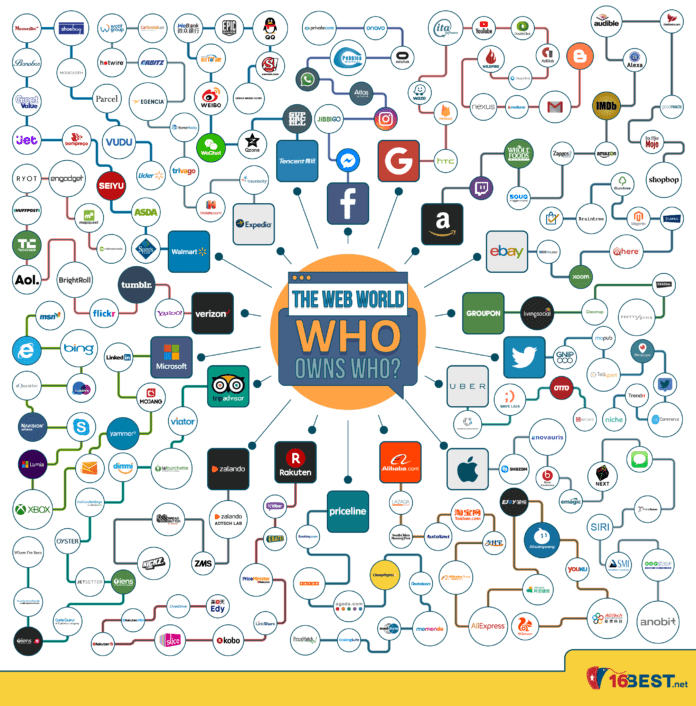

The infographic below shows the dominance of certain tech titans running through the intricacies of the web. While the jury is still out on whether this dominance is a good or bad thing, it is clear that all these competition has made life more convenient for users who can do more, play more, and think more artificially.

https://www.16best.net/blog/the-web-world-who-owns-who/

Watch out for Part 2: Facebook, Amazon, Baidu, Alibaba

Preview:

Where does Facebook come in all of these? Mark Zuckerberg has kept “enemies” close to his chest by acquiring them – Friendster, WhatsApp, Instagram and now Oculus, a virtual reality company are now part of the Facebook family.

Credits: Kathnik Reddy, Who Owns Who?